Book Radar Agtech- Survey of Brazilian startups in the agricultural sector (Brazil 2020- 2021) now available in English

Book Radar Agtech- Survey of Brazilian startups in the agricultural sector (Brazil 2020- 2021) now available in English

The book “Radar Agtech Brasil” raises the visibility of Brazilian agricultural startups in international agribusiness innovation ecosystems

The most comprehensive map of startups in the Brazilian agricultural sector, the book Radar Agtech Brasil has been translated into English and is now available for free download. This edition was published by Embrapa in partnership with SP Venture and Homo Ludens Research & Consulting, and it features a survey of operating agricultural tech-based companies and their main investors.

There are great expectations for Radar Agtech Brasil’s English version according to Embrapa’s Executive Director of Innovation and Technology, Adriana Regina Martin, for whom this edition “adds value to the mapping because it promotes the country’s agtech sector globally and creates opportunities for Brazilian agribusinesses in the international market”. That opinion is shared by the Homo Ludens partner and co-coordinator of the study, Luiz Sakuda, because “once published in a foreign language, the publication gives greater visibility for agtechs in international ecosystems and opens business opportunities abroad”.

Since its first edition, in 2019, Radar Agtech Brasil has been a reference for the agrifood sector and has drawn attention from the international agribusiness innovation ecosystem, a relevance that motivated the English translation. “Many investment funds focused on technology innovation for the agricultural and agrifood sector are based in English-speaking countries”, says Marcella Falcão, community development coordinator at SP Ventures.

Brazilian Panorama

The English version of Radar Agtech Brazil is rich in charts and tables, and presents the panoramas of the agtech ecosystem, of relationships with different players and of funding in Brazil. The publication also describes the methodology to map and collect data on the profile, location, segment and business field of 1,574 startups working in the Brazilian agribusiness sector and on 78 institutions that supported incubation and acceleration processes and invested in those businesses.

All this information has been collected both from the startups themselves and from public databases on agricultural research and on startup ecosystems. It also considers studies done by development agencies that fund research and enterprises, contributing to the diagnosis of investments in the sector and to an agtech taxonomy and classification.

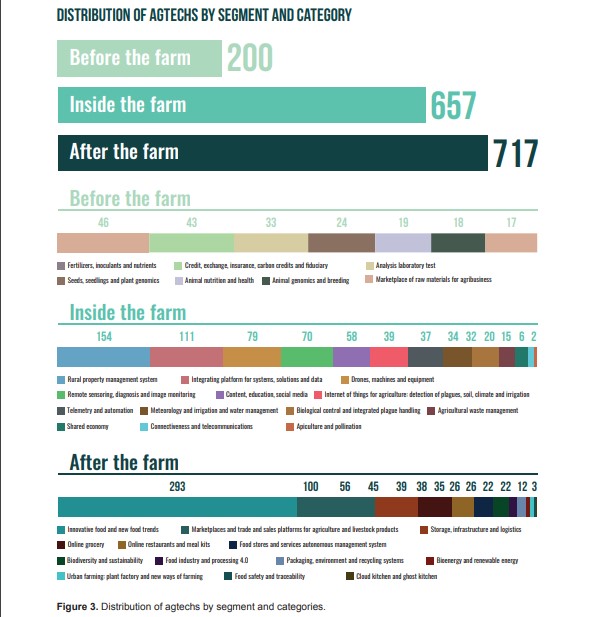

The survey organizes startups into 3 categories (‘before the farm’, ‘inside the farm’ and ‘after the farm’) and according to types of solutions: gene editing, robotics, AI, blockchain, synthetic proteins, nanotechnology, cellular agriculture, and machine learning.

Pandemic impacts and Brazil-China cooperation

In addition to the panorama of Brazilian agtechs, the Radar Agtech Brasil includes a specific chapter about the impact of the COVID-19 pandemic on Brazilian agribusiness, which despite the global and national economic deflation, in the course of 2020 and 2021 showed growth, including a record grain harvest in 2020, which reinforces the strength of Brazilian agribusiness (CNA, 2021).

Another way the Radar contributes to innovation ecosystems is by showcasing the partnership between Brazil and China in a chapter chapter that analyzes agricultural innovation ecosystems in each country based on market characteristics, innovation structure and agtech entrepreneurial movement. This initiative aims at the internationalization of startups and at attracting foreign investment for the agribusiness sector.

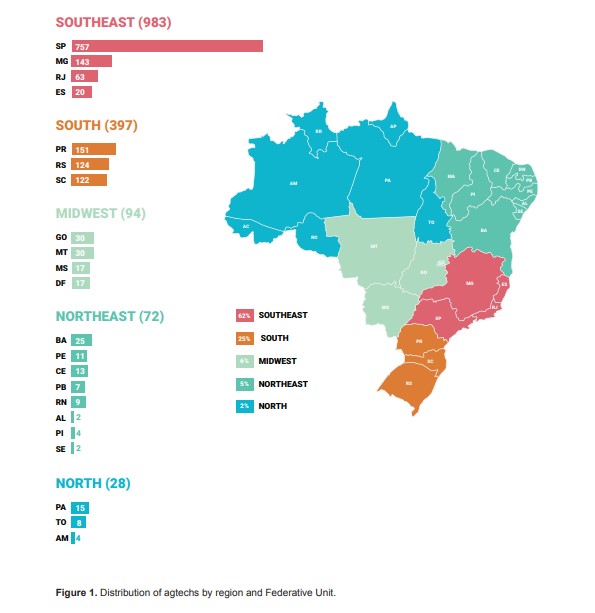

Data presented by the radarPercentage of agtechs per Brazilian region: Southwest (62.4%- 983), South (25.2%- 397), Midwest (6.1%- 96), Northwest (4.6%- 72), and North (1.7% - 26).

Five Brazilian states concentrate 82.4% of all the agtechs that were mapped: São Paulo (48.1%- 757), Paraná (9.6%- 151), Minas Gerais (9.1%- 143), Rio Grande do Sul (9% - 124) and Santa Catarina (6.2%- 122). The top 5 agtech categories mapped:

Before the farm: Fertilizers, Inoculants and Plant Nutrition (46); Credit, exchange, insurance, carbon credits and fiduciary analysis (42); Laboratory analysis (33); Seeds, Seedlings and Plant Genomics (24); and Animal Nutrition and Health (19); Inside the farm: Rural Property Management System (154); Systems, solutions and data integration platform (111); Drones, Machines and Equipment (79); Remote Sensing, Diagnosis and Image Monitoring (70) and Content, Education, Social Media (58); After the farm: Innovative food and new food trends (293); Marketplaces and Platforms to trade and negotiate agricultural products (100); Storage, Infrastructure and Logistics (57); Online Grocery Store (45) Online Restaurants and Meal Kits (39). |

Launch in the Netherlands

Radar Agtech Brasil’s English edition was launched by SP Venture during the F&A Next 2022: Investors Meet Food and Agri Startups, which occurred on May 18th and 19th, 2022, in Wageningen, Netherlands.

Radar Agtech Brasil’s English edition was launched by SP Venture during the F&A Next 2022: Investors Meet Food and Agri Startups, which occurred on May 18th and 19th, 2022, in Wageningen, Netherlands.

Sign-up

The selection to participate in Radar Agtech Brasil is open until May 31th, 2022. Any startup that operates in the Brazilian agricultural sector can sign up to join the new survey for free by accessing the link: https://bit.ly/radaragtech

Selma Lúcia Lira Beltrão (MTb 2490/DF)

Secretaria de Inovação e Negócios (SIN)

Press inquiries

imprensa@embrapa.br

Further information on the topic

Citizen Attention Service (SAC)

www.embrapa.br/contact-us/sac/