Embrapa Dairy Cattle

Busca de Notícias

Busca de Notícias

Experts believe Brazilian milk market will recover this year

The 2016 figures are going to be published by the Brazilian Institute of Geography and Statistics (IBGE) on March 17, but the expectation is that milk production in Brazil has suffered the biggest fall in 55 years, since records started. "Although formal milk collection in the third quarter of the last year recovered in 12.1% with respect to the previous quarter, the total volume collected fell 4,9% in comparison with the same period in 2015", informs the Embrapa Dairy Cattle researcher João César Resende.

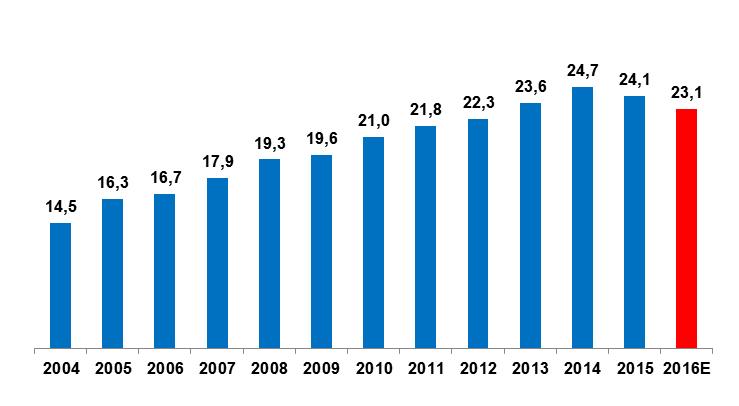

Preliminary data suggest that the pace of recovery was maintained in the last quarter, but the country should close 2016 with a production slightly above 23 billion liters, a retraction of over 3% from 2015, and there are even analysts who bet the figure will reach 4%. The last two years were not good for the sector. Since 2014, when Brazil recorded the largest milk production volume under inspection (24.7 billion liters), the indicators have been receding. In 2015, the fall was of 2.8% (figure 1).

Figure 1: Milk production under inspection in Brazil (billion liters):

Source: IBGE, adapted by Embrapa (2016: Embrapa Dairy Cattle Estimate).

Year of extremes

One of the factors that favored the production of a lower volume was international milk prices. At Global Dairy Trade (GDT) auctions, the ton of milk powder was sold in July for US$ 2,062.00, a price much below the average, according to analysts. That favored milk imports from Argentina and Uruguay. "We imported the equivalent to 8% of our milk collection in the past year", explains another researcher from Embrapa Dairy Cattle, Glauco Rodrigues Carvalho. In December, the GDT auction was paying US$ 3,568.00 for the powder milk ton. Carvalho expects that to be the average for international prices throughout 2017, reducing the competitiveness of imports and making a recovery in domestic production possible.

Another factor that harmed the sector was a failure in the corn harvest. While the grain harvest in 2014/2015 was of 84.3 million tons, in the 2015/2016 period there was a 21% decrease (66.5 million tons). That increased the cost of the herd's concentrated feed, increasing costs for farmers. "We experienced extreme facts in 2016, which showed the disorganization and the fragility of the milk production chain in Brazil", Carvalho argues. Such fragility was especially reflected in the prices paid to farmers. The year started with very with low prices, as the dairy farmer received R$ 1.06/liter. The average for the first half of the year was below R$ 1.20.

As a consequence, there was a fall in industrial activity, as industries reached an idle capacity of around 40%. To increase earnings from the product, the reaction was to increase prices, whose average in the second semester was R$ 1.49/liter. Carvalho informs that peak prices occurred in August (R$ 1.69), but milk was bought from some farmers for over R$ 2.00/liter. "With such a broad range of prices, it is difficult for any sector to plan itself", asserts the researcher.

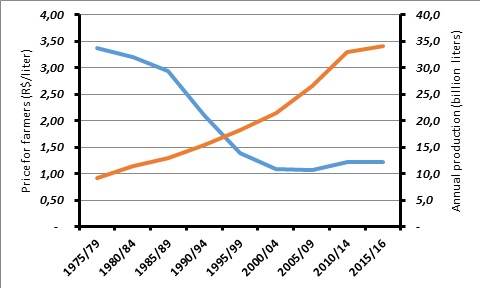

In spite of a year of such large variations, since 2010, the amount paid to milk producers has presented a certain regularity, as Figure 2 shows. Brazil's total production (inspected milk plus informal milk) shows an ascending curve as prices fall, which, according to Resende, demonstrates the activity's potential: "In the long run, the dip in prices paid to farmers will reflect reduced production costs in the period. We have a more efficient production sector, which has technologically modernized itself. And prices for consumers also follow the tendency to fall. If the modernization hadn't taken place, today we would be paying more than R$ 4.00 for the liter of milk".

Figure 2: Evolution of production (orange) and prices paid to farmers in Brazil (blue), 1975/2016:

Source: IBGE and IEA (Organization: Embrapa Dairy Cattle).

Trends favor the domestic market

Carvalho asserts that, for this year, a production volume that is higher than in 2015 and 2016 is expected, but without excess supply. "It will be a year of harvest recovery, as the average milk to input ratio tends to improve". Corn, responsible for the increase in the costs of concentrate in 2016, tends to have friendlier prices. The expectation is that the 2016/2017 grain harvest turns over 84 million tons. The estimate for the winter harvest alone is 56 million tons. The researcher expects that the grain harvest in Brazil, headed by soybeans, hits records this year.

As aforementioned, international milk prices tend to go up, which hinders imports and favors the domestic scenario. The upward trend in international prices is mainly anchored in the desacceleration of production in Europe and in the recent decrease in supply in Oceania and in Latin America. The fact the dollar currency exchange rate has remained high also encourages domestic production, increasing the relative competitiveness of exports compared to imports.

"From the point of view of domestic consumption, there is also a trend towards gradual improvement", Carvalho points out. "Despite the fragile national political and economic scenario, indicators have improved and the prospect is that inflation, interest rate and the GDP follow a patch toward stimulating consumption, promoting a recovery of economic growth, even if it is modest", he concludes.

The researcher stresses that, regardless of conjunctural oscillations, important changes are happening in the milk production chain in Brazil. He lists some of such changes:

- Improved property management;

- Higher specialization of the Brazilian herd (IBGE's 2015 data show a 5.5% fall in the number of dairy cows, which means that animals with worse genetics are being discarded);

- Higher speed in technology adoption, which generates productivity gains (some Brazilian microregions have productivity that compares to first world countries);

- Lower corn and soybean production costs in the world.

"Such elements, on top of suitable climate, land availability, relative water abundance, and consumption potential of a continental population, make Brazilian dairy farming an agricultural activity with high potential", affirms Carvalho. But he recalls that producing milk demands management, dedication and technology, just like all economic activities. "Those who manage to gather such caracteristics are the entrepreneurs who will keep being successful in the activity, ensuring good earnings and an increasingly more economically sustainable production", he concludes.

Translation: Mariana de Lima Medeiros

Rubens Neiva (MTb 5445)

Embrapa Dairy Cattle

Press inquiries

gado-de-leite.imprensa@embrapa.br

Phone number: +55 32 3311-7532

Further information on the topic

Citizen Attention Service (SAC)

www.embrapa.br/contact-us/sac/