Brazil to profit more from soybeans by prioritizing grain quality

Brazil to profit more from soybeans by prioritizing grain quality

The average protein content found in Brazilian soybeans between the 2014/15 and the 2016/17 crop years was approximately 2% above the one found in grains produced in the United States. On the other hand, defective grains caused annual losses of R$ 1 billion to the national soybean sector. The results are from a study made by Embrapa Soybean (Londrina, PR) son economic aspects related to the quality of grains in Brazil based on two attributes: protein content and percentage of damaged (defective) grains. "This study aims to introduce a discussion on aspects related to soybean quality so that qualitative attributes can be duly valued in their trade", Embrapa's economic analyst Marcelo Hirakuri explains.

The study was performed in ten Brazilian states: Rio Grande do Sul, Santa Catarina, Paraná, São Paulo, Mato Grosso do Sul, Mato Grosso, Goiás, Minas Gerais, Bahia, and Tocantins, which, when combined, are responsible for about 93% of the national production.

| Brazil endured over R$ 1 billion in losses due to damaged grains |

Major losses

With regard to the damaged grains, a large portion of the harvested soybeans exceeded the 8% tolerance for defective grains allowed by law. Some regions presented samples with up to 30% of damaged grains, which represent the sum of molded, slightly and fully burned, fermented, immature, wilted, germinated and stinkbug-damaged grains. "These cases represent losses for the farmers, as owners of storage facilities can deduct the percentage that is damaged, since this material has low quality for the industry", assesses the Embrapa researcher Irineu Lorini.

"In the case of damaged grains, estimated economic losses reached an amount above R$ 1 billion, considering the percentage of the production that exceeded the 8% limit, the amount that exceeded it and the price paid for soybeans in the states", Hirakuri estimates. The main flaws observed were fermentation and damage by stinkbugs, which accounted for 84.6% of defects in the damaged soybean grains.

Lower economic losses were observed in the states of Santa Catarina and Rio Grande do Sul, as a small portion of the harvested soybeans exceeded the tolerated limit. The states of Minas Gerais, São Paulo, Bahia and Tocantins had economic losses between R$ 10.4 million and R$ 19.5 million.

Protein content is competitive advantage

Soybeans are mainly valued due to their high protein content, which is higher than that of other oilseeds. That is why the grains have become essential raw material for the production of protein bran, mostly used to manufacture feed for poultry, swine, bovines and small-sized animals. "Quality is a favorable aspect, both for the Brazilian soybean consuming industry and for countries that import the grain on a large scale, as is the case of China", Hirakuri explains.

While the average protein content of Brazilian soybeans in the three harvests analyzed was of 36.69%, American soybeans' was 34.70%, between 2006 and 2015, falling to 34.1% in the 2017 harvest, according to the United States Soybean Export Council. "Brazil could commercially explore this fact, because each Brazilian ton that is exported has 2% more protein, compared to American soybean", Lorini underscores. In 2017, China, for instance, imported almost 65% of all of the world's soybean exports to internally produce bran instead of importing the byproduct. "However, the grain is quantitativele valued and measured in tons, which does not consider inner protein", he explains.

Protein per state

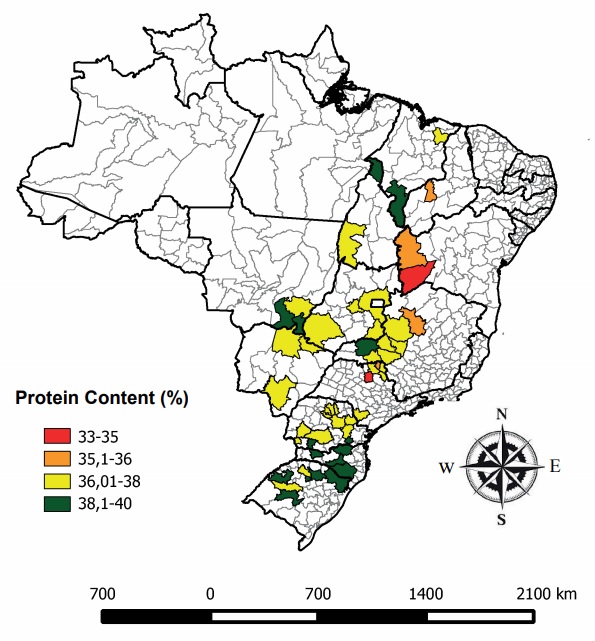

In the 2016/17 crop year, the average protein content in the soybean grains varied between 32.03% and 41.35% in the 903 samples analyzed. The state that presented the highest average protein content was Bahia, with 38.16%, while Paraná was the state with the lowest average: 36.74%.

Protein content (%) in soybean grains from different Brazilian state microregions in the 2016/17 crop year. The colors represent the intensity of the trait in different Brazilian microregions.

Embrapa calculated the figure paid per soybean protein percentage and the averages varied between R$ 25.57 and R$ 28.79 per ton, considering the prices paid in each state and the protein content obtained. The lower average amount paid per protein percentage in 2017 observed in the state of Mato Grosso, where the ton of soybean had the lowest sales price in the year: R$ 938.06. Hypothetically, if a single amount for the soybean ton in Brazil is considered, the higher the protein content in each region, the lower the value paid for the percentage of protein in the grain.

For example, even though the quote for soybean in Bahia (R$ 1,006.47/t) was slightly lower than the one verified for Minas Gerais (R$ 1,017.75/t) in 2017, the amount paid per protein percentage in the ton of the grain in the Northeastern state was significantly lower. That is because Bahia showed the highest average protein content in Brazil, with 38.16%.

The higher the protein content in the grains, the better for the production of brans ranging from those with minimum protein contents required by legislation, to brans with high protein content. "The higher the protein content in the grains used to produce brans, the lesser the industrial processes necessary to comply with standards", explains the researcher José Marcos Gontijo Mandarino, from Embrapa Soybeans.

Lorini explains that, at the moment, Brazil does not estimate economic values for soybean protein because farmers earn for each ton they deliver, regardless of the protein content. "If quality starts to be assessed, farmers would have a bonus if the protein content was above average or followed a minimal reference", he explains. "On the other hand, the price would be discounted if the protein content was below such reference. The important thing is that we have information on the quality of the soybeans produced in the country and that it can be part of the product's added value in the market", he concludes.

Translation: Mariana Medeiros

Lebna Landgraf (MTb 2903/PR)

Embrapa Soybean

Press inquiries

soja.imprensa@embrapa.br

Phone number: +55 43 3371-6061

Further information on the topic

Citizen Attention Service (SAC)

www.embrapa.br/contact-us/sac/